- More

- Back

- About us

- Practice Areas

- Publications

- CSR

- Firm Policy

- Firm Policy

- POSH Policy

- Contact us

Taxbuzz | Key Announcements by Finance Minister in relation to Statutory Income Tax Compliance(s) March 25, 2020

Published in: COVID-19, TaxBuzz

Disclaimer: While every care has been taken in the preparation of this TaxBuzz to ensure its accuracy at the time of publication, Vaish Associates Advocates assumes no responsibility for any errors which despite all precautions, may be found therein. Neither this bulletin nor the information contained herein constitutes a contract or will form the basis of a contract. The material contained in this document does not constitute / substitute professional advice that may be required before acting on any matter. All logos and trademarks appearing in the newsletter are property of their respective owners.

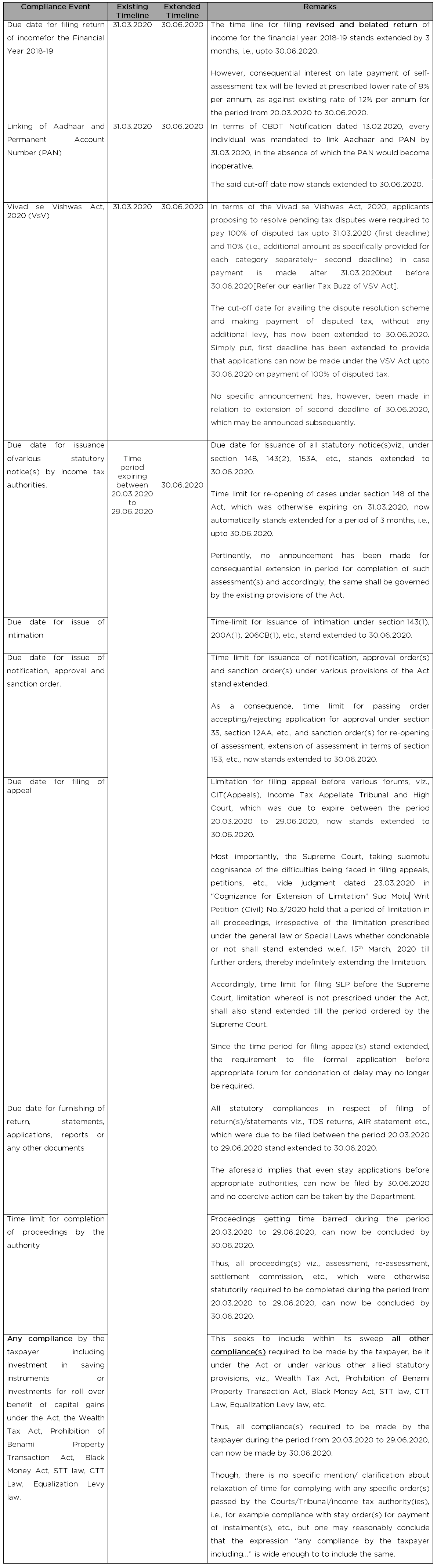

The Hon’ble Finance Minister vide press conference held on 24.02.2020, announced several important relief measures taken by the Government of India in view of COVID-19 outbreak, especially in the much needed area of statutory compliances under the Income Tax, which are tabulated hereunder:

Reduced Interest rates

The press release states that interest at reduced rate of 9% per annum is required to be paid in case of delayed payments of advance tax, self-assessment tax, regular tax, TDS, equalization levy, securities transaction tax, commercial transaction tax, which are required to be paid during the period 20.03.2020 and 29.06.2020 instead of 12%/18% per annum (i.e., 0.75% per month as against 1%/1.5% per month). Further, it has been clarified that no late fee/penalty shall be charged for delay relating to this period.

There is, thus,no complete waiver of interest on late payment of taxes, and the taxpayer shall be required to pay interest at reduced of 9% per annum for period from 20.03.2020 to 29.06.2020. Incidental penalty(ies)/ fees have, however, been completely waived.

Necessary legal circulars and legislative amendments for giving effect to the aforesaid relief is expected to be issued in due course.

For any details and clarifications, please feel free to write to:

Mr. Rohit Jain at [email protected]

Ms. DeepashreeRao at [email protected]