- More

- Back

- About us

- Practice Areas

- Publications

- CSR

- Firm Policy

- Firm Policy

- POSH Policy

- Contact us

SEBI Outlines the Process for Dematerialisation / Crediting of Units by AIFs Where Investors Haven’t Provided Demat Account Details December 11, 2023

Published in: Investment Funds

DISCLAIMER: The material contained in this publication is solely for information and general guidance and not for advertising or soliciting. The information provided does not constitute professional advice that may be required before acting on any matter. While every care has been taken in the preparation of this publication to ensure its accuracy, Vaish Associates Advocates neither assumes responsibility for any errors, which despite all precautions, may be found herein nor accepts any liability, and disclaims all responsibility, for any kind of loss or damage arising on account of anyone acting / refraining to act by placing reliance upon the information contained in this publication.

In June 2023, Securities and Exchange Board of India (“SEBI”) mandated all schemes of Alternative Investment Funds (“AIFs”) to issue or convert their units in dematerialised form within a specified timeframe.

SEBI, vide its circular dated December 11, 2023, has now laid down the process for dematerialising/ crediting the units issued by AIFs, where investors are yet to provide demat account details to AIFs.

The said circular sets out that managers of AIFs shall continue to reach out to existing investors to obtain their demat account details and credit the units issued to them to their respective demat accounts. In this regard, the AIF industry and depositories have been directed to adopt implementation standards as formulated by the pilot Standard Setting Forum for AIFs (SFA) along with the 2 depositories, in consultation with SEBI.

Further, units already issued by schemes of AIFs to existing investors who have not provided their demat account details, shall be credited to a separate demat account named ‘Aggregate Escrow Demat Account’. New units to be issued in demat form shall be allotted to such investors and credited to the Aggregate Escrow Demat Account. As and when such investors provide their demat account details to AIFs, their units held in the Aggregate Escrow Demat Account shall be transferred to the respective investors’ demat account within 5 working days.

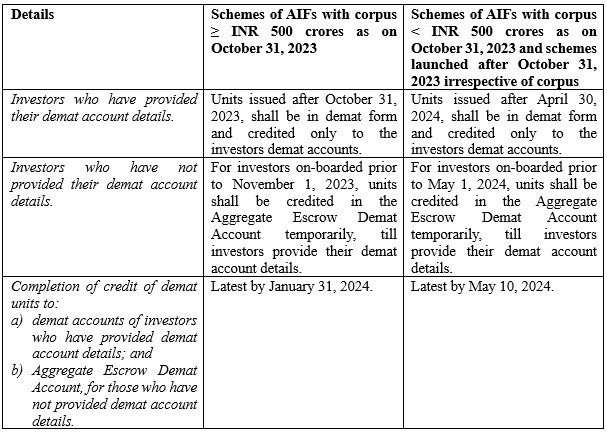

The circular clarifies the following with respect to issuance and credit of units of AIFs in demat form:

To read the circular click here

For any clarification, please write to:

Mr. Yatin Narang

Partner

[email protected]