Highlights Of 47th GST Council Meeting July 1, 2022

Published in: GST Cafe

DISCLAIMER: The material contained in this publication is solely for information and general guidance and not for advertising or soliciting. The information provided does not constitute professional advice that may be required before acting on any matter. While every care has been taken in the preparation of this publication to ensure its accuracy, Vaish Associates Advocates neither assumes responsibility for any errors, which despite all precautions, may be found herein nor accepts any liability, and disclaims all responsibility, for any kind of loss or damage of any kind arising on account of anyone acting/ refraining to act by placing reliance upon the information contained in this publication.

The 47th GST Council (the ‘Council’) meeting was held on 28th and 29th June, 2022, under the chairmanship of Union Finance and Corporate Affairs Minister Smt. Nirmala Sitharaman. During the course of the meeting, the Council dealt with important issues and in retrospect, issued Press Release with its recommendations.

Overview of Recommendations:

The Council has, inter alia, made the following recommendations relating to changes in GST rates on supply of goods and services and changes related to GST law and procedure:

A. Recommendations related to laws and procedures:

- Time period from 01.03.2020 to 28.02.2022 to be excluded from calculation of the limitation period for filing refund claim by an applicant u/s. 54 and 55 of CGST Act, as well as for issuance of demand order (by proper officer) in respect of erroneous refunds u/s. 73 of CGST Act. Further, limitation under section 73 for FY. 2017-18 for issuance of order in respect of other demands linked with due date of annual return, to be extended till 30.09.2023.

- In-principal approval for relaxation in the provisions for suppliers making supplies through e-commerce operators (‘ECOs’):

- Waiver of requirement of mandatory registration u/s. 24(ix) of CGST Act for person supplying goods through ECOs, subject to certain conditions.

- Composition taxpayers to be allowed to make intra-State supply through e-commerce operators subject to certain conditions.

- Change in formula for calculation of refund under rule 89(5) to take into account utilization of ITC on account of inputs and input services for payment of output tax on inverted rated supplies in the same ratio in which ITC has been availed on inputs and input services during the said tax period.

- Amendment in rule 96 of CGST Rules recommended to provide for expeditious disposal of IGST refund claims in cases where exporter is identified as risky exporter requiring verification by GST officers, or where there is a violation of provisions of Customs Act and refund claims in respect of export of goods are suspended/ withheld.

- FORM GST PMT-03A to be introduced to enable taxpayer to re-credit the amount in Electronic Credit Ledger in cases where erroneous refund amount is sanctioned on account of accumulated ITC or on account of IGST paid on zero rated supply of goods or services.

- Late fee for delay in filing FORM GSTR-4 for FY. 2021-22 waived till 28.07.2022. Further, due date of filing of FORM GST CMP-08 for the 1st quarter of FY. 2022-23, extended to 31.07.2022.

- Present exemption of IGST on import of goods under AA/EPCG/EOU scheme to be continued.

- Exemption from filing annual return in FORM GSTR-9/ 9A for FY. 2021-22 to be provided to taxpayers having Annual Aggregate Turnover up to Rs. 2 crores.

- Explanation 1 after rule 43 of CGST Rules to be amended to provide non requirement of reversal of input tax credit for exempted supply of duty credit scrips by the exporters.

- UPI & IMPS to be provided as an additional mode for payment of GST to taxpayers under Rule 87(3) of CGST Rules.

- Amendment in CGST Rules to provide for refund of unutilized input tax credit on account of export of electricity.

- Supplies from Duty Free Shops (DFS) at international terminal to outgoing international passengers to be treated as exports by DFS and consequential refund benefit to be available on such supplies. Accordingly, Rule 95A of the CGST Rules, Circular No. 106/25/2019-GST dated 29.06.2019 and related notifications to be rescinded.

- Provision for automatic revocation of suspension of registration to be introduced in cases where registration is suspended by the system in case of continuous non-filing of specified number of returns, once all the pending returns are filed on the portal by the taxpayer.

B. Recommendations related to GST rates on goods and services:

- Rate rationalisation recommended for various goods and services such as printing, writing, drawing ink, knives, power driven pumps, LED lamps, lights, fixtures, solar water heaters etc., in order to resolve the issue of inverted duty. Further, refund of accumulated ITC would not be allowed on edible oils and coal.

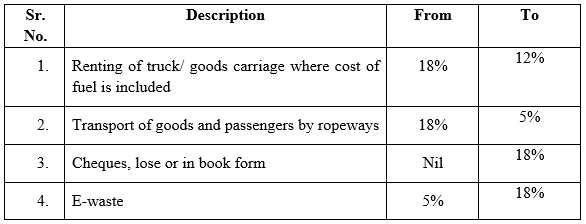

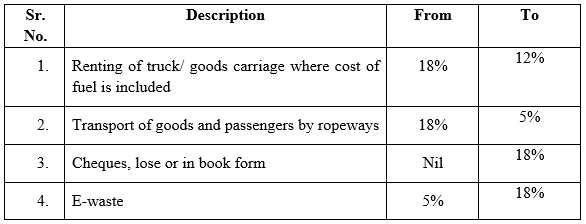

- Relevant changes in GST rates/ removal of exemptions recommended by the Council:

- Further, Council has recommended rationalisation of following exempted services:

- Exemption on transport of passengers by air to and from NE states & Bagdogra to be restricted to economy class.

- Exemption on following services being withdrawn:

- transportation of railway equipment and material by rail or a vessel.

- storage or warehousing of commodities which attract tax (nuts, spices, copra, jaggery, cotton etc.)

- fumigation in a warehouse of agricultural produce.

- services by RBI, IRDA, SEBI, FSSAI,

- Services supplied by GSTN.

- renting of residential dwelling to business entities (registered persons).

- services provided by cord blood banks by way of preservation of stem cells.

- Hotel accommodation having tariff up to Rs. 1,000 per day shall be taxed at 12%.

- Room rent (excluding ICU) exceeding Rs. 5,000 per day per patient charged by a hospital shall be taxed (to the extent amount charged for the room) at 5% without ITC.

- Tax exemption on training or coaching in recreational activities relating to arts or culture or sports is being restricted to such services when supplied by an individual.

- The Council has directed the Group of Ministers to re-examine the issues related to taxability of casino, race course and online gaming.

- Relevant summary of clarifications in relation to GST rates on goods and services:

- Electric vehicles whether or not fitted with a battery pack, are eligible for the concessional GST rate of 5%.

- Sewage treated water is exempted from GST and is not the same as purified water provided in S. No. 99 of notification 2/2017-CT(Rate).

- Due to ambiguity in GST rates on supply of ice-cream by ice-cream parlours, GST charged @ 5% without ITC on the same during the period 1.07.2017 to 5.10.2021, regularized to avoid unnecessary litigation.

- Application fee charged for entrance or issuance of eligibility certificate for admission or issuance of migration certificate by universities is exempt from GST.

- Services associated with transit cargo both to and from Nepal and Bhutan are covered by exemption under entry 9B of notification No. 12/2017-CT(R) dated 28.06.2017.

- Activity of selling of space for advertisement in souvenirs published in the form of books is eligible for concessional GST at 5%.

- Renting of vehicle with operator for transportation of goods on time basis is classifiable under Heading 9966 (rental services of transport vehicles with operators) and attracts GST at 18% GST. Where cost of fuel is included in the consideration charged, the rate being prescribed is 12%.

- Sale of land after levelling, laying down of drainage lines etc. not to attract GST.

- Renting of motor vehicles on time basis to a body corporate for transport of passengers taxable in the hands of body corporate under RCM.

- Services in form of Assisted Reproductive Technology (ART)/ in vitro fertilization (IVF) covered under the definition of “health care services” for the purpose of exemption.

- GTA given option to pay GST at 5% or 12% under forward charge; option to be exercised at the beginning of FY. RCM option to continue.

VA Comments:

The aforesaid recommendations related to laws and procedure are aimed at providing relief to small taxpayers. Waiver of requirement of mandatory registration by small suppliers making supplies through e-commerce operators is a welcome relief. Further, amendment in Rule 96 would result in expeditious disposal of withheld/ suspended IGST refund claims.

Recommendation of excluding time period from 01.03.2020 to 28.02.2022 vis-à-vis calculation of limitation period for filing refund claim is a much-sought relief and in line with the judgement of Hon’ble SC in Suo Moto Writ Petition (Civil) No. 3 of 2020.

The rate changes recommended by the Council will be effective from 18.07.2022. Rationalisation of GST rates and removal of exemption on various goods and services would, however, burden the taxpayers.

For any further information/ clarification, please feel free to write to Mr. Shammi Kapoor, Partner at [email protected]

DOWNLOAD PDF FILE