Securities and Exchange Board of India (“SEBI”), vide its notification dated November 18, 2024, had notified the SEBI (Alternative Investment Funds) (Fifth Amendment) Regulations, 2024 (“AIF Amendment Regulations”), thereby amending the SEBI (Alternative Investment Funds) Regulations, 2012 (“AIF Regulations”). The amendments were introduced with respect to maintaining pro-rata and pari-passu rights of investors in a scheme of an Alternative Investment Fund (“AIF”).

SEBI, vide its circular dated December 13, 2024 (“AIF Circular”) had further laid down the guidelines in respect of granting pro-rata and pari-passu rights of investors of AIFs.

The AIF Circular has specified that differential rights may be offered by AIFs to select investors without affecting the rights of other investors, based on the following guiding principles:

- Any such right shall not result in any investor bearing liability accrued or accruing to other investors of the AIF/ scheme of AIF;

- Any such right with respect to non-monetary/ non-commercial terms shall not provide control to an investor on the decision making of the AIF/ scheme of AIF, except in cases where investor/ its nominee is part of the Investment Committee constituted by the manager;

- Any such right shall not alter the right(s) available to other investors under their respective agreements with the AIF/manager; and

- Any such right and eligibility to avail the same shall be transparently disclosed in the Private Placement Memorandum (“PPM”) of the AIF/ scheme of AIF.

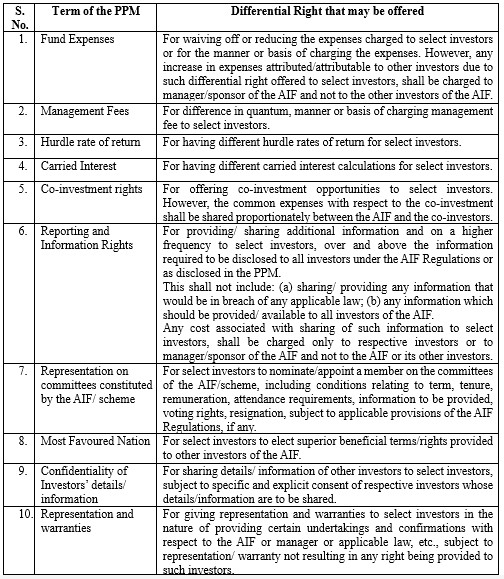

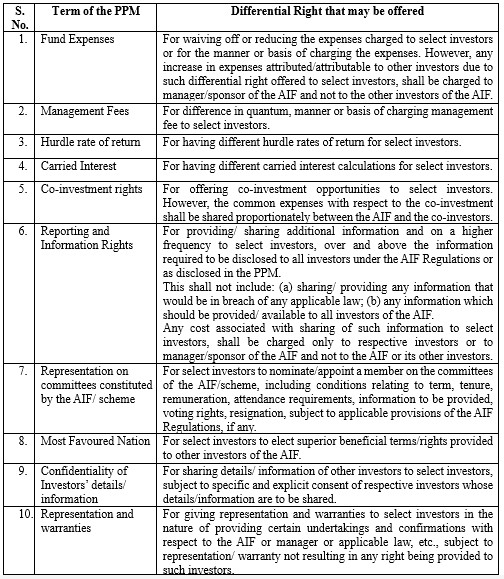

In this regard, Standard Setting Forum for AIFs (“SFA”) on January 28, 2025, has released the below mentioned implementation standards, prescribing the positive list of specific differential rights that may be offered by AIFs.

Further, (a) any information provided to select investors which elaborates AIF documents in line with the AIF Regulations and circulars and (b) right in the nature of providing specific treatment to select investors to comply with laws or regulations applicable to them, will not be considered as a differential right.

To read the AIF Amendment Regulations click here, to read the AIF Circular click here & to read the SFA Implementation Standards click here

For any clarification, please write to: