Challenge to resolution plan by SEBI dismissed by National Company Law Appellate Tribunal

National Company Law Appellate Tribunal (“NCLAT”) in Securities and Exchange Board of India v. Assam Company India Limited and Others (decided on August 29, 2019) held that a resolution plan requiring delisting of shares of the corporate debtor against which Securities Appellate Tribunal (“SAT”) had passed an interim order would be valid.

FACTS

After a Corporate Insolvency Resolution Process (“CIRP”) was initiated against Assam Company India Limited (“Corporate Debtor”), by an order dated September 20, 2018, National Company Law Tribunal, Guwahati Bench (“NCLT Guwahati”) approved the resolution plan submitted by BRS Ventures Investment Limited (“Successful Resolution Applicant”). Securities and Exchange Board of India (“SEBI”) challenged the order of approval of the said resolution plan as the said resolution plan provided for delisting the shares of the Corporate Debtor.

Before the initiation of the CIRP, SEBI had received a letter from the Ministry of Corporate Affairs (“MCA”) dated June 09, 2017 (“MCA Letter”) along with a copy of letter dated May 23, 2017 from Serious Fraud Investigation Office (“SFIO”) annexing a list of 331 shell companies, the Corporate Debtor being one of them. Accordingly, SEBI issued interim directions to the concerned stock exchanges to take certain actions against the Corporate Debtor. This prompted the Corporate Debtor to approach SAT which resulted in an adverse interim order by the SAT requiring a forensic audit to be conducted on the Corporate Debtor. Various opportunities were given thereafter to the Corporate Debtor to file its reply or objections to the said interim order, however it failed to do so. Instead, the Corporate Debtor filed a writ petition before the Guwahati High Court challenging the MCA Letter wherein the Guwahati High Court set aside the MCA Letter. SEBI challenged the said order before a larger bench of the Guwahati High Court. Thereafter, SEBI received an intimation from the stock exchanges that NCLT Guwahati had approved a resolution plan which provided for delisting of the equity shares of the Corporate Debtor. Aggrieved by the approval of the resolution plan, SEBI approached the NCLAT.

ISSUE

Whether the order of NCLT Guwahati approving the resolution plan of the Corporate Debtor should be reversed?

ARGUMENTS

The counsel for SEBI submitted that the approved resolution plan had the effect of denuding the jurisdiction of SEBI under the provisions of the Securities and Exchange Board of India Act, 1992 (“SEBI Act”) in an indirect manner. Further, the Corporate Debtor had not taken any steps to file a reply or objections to the interim order of the SAT. All of this contravenes SEBI Act and would accordingly be hit by Section 30(2)(e) of the Insolvency and Bankruptcy Code, 2016 (“IBC”). It was also argued that the effect of the impugned clause in the resolution plan was that the equity shares of the Corporate Debtor shall stand delisted from the concerned stock exchanges which will not only render the action initiated by SEBI in conjunction with the said stock exchanges against the Corporate Debtor, nugatory and ineffective, but also compel public shareholders to exit for a very meagre amount, which would not be in the interest of investors and the securities market.

The investigations of SEBI under the provisions of the SEBI Act and the regulations made thereunder, other laws specified in the secretarial audit report and prima facie observations regarding misuse of books of funds by the Corporate Debtor ought not be permitted to be scuttled by adopting the method of delisting of the equity shares of the Corporate Debtor, by way of approval of the resolution plan in an attempt to wriggle out of the jurisdiction of and proceedings instituted by SEBI. Additionally, the resolution plan should not have been proceeded without a right to be heard being given to SEBI. Further, it was also submitted that the Single Judge of the Guwahati High Court had only quashed the MCA Letter and not the letter of the SFIO.

It was argued for the Corporate Debtor and the Successful Resolution Applicant that the sole ground taken by SEBI was that there are pending investigations initiated against the Corporate Debtor as a shell company and therefore the delisting of equity shares should not be allowed in terms of the resolution plan. However, the Guwahati High Court had already set aside the investigation. In the appeal filed by SEBI against the order of the Guwahati High Court, no order of stay had been passed. Further, the Corporate Debtor cannot be treated as a shell company after it has been taken over by Successful Resolution Applicant pursuant to the resolution plan. It was submitted that apart from protecting rights of all the stakeholders including financial creditors and operational creditors, the rights of public shareholders had also been protected.

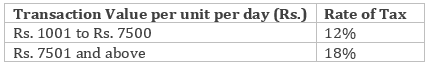

The liquidation value of the Corporate Debtor would be much lower than the amount payable to financial creditors and therefore the liquidation value of the Corporate Debtor had been assessed to be NIL. Further, the Successful Resolution Applicant in its plan has provided a sum of INR 1.82 crores for the public shareholders which is in consonance with the Gazette Notification dated May 31, 2018 issued by SEBI for delisting of shares pursuant to the resolution plan approved under Section 31 of the IBC. The resolution plan provided for exit route to the public shareholders by earmarking INR 1.82 crores for cancellation of their shares and no individual and/or entity having any dues had been deprived of any amount under the approved resolution plan.

Since the approved resolution plan had taken care of interest of the public shareholders and all the stakeholders, the apprehension of SEBI was completely misplaced.

FINDINGS OF THE NCLAT

NCLAT referred to the relevant portions of the resolution plan submitted by the Successful Resolution Applicant concerning the delisting of the shares of the Corporate Debtor. It also referred to Section 30(2)(e) and Section 32 read with Section 61 of the IBC which deal with approvals of resolution plans and appeals from order approving the resolution plan. One of the grounds for examining a resolution plan and where an appeal can be filed against an order approving a resolution plan is if the said resolution plan is in contravention of the provisions of any law for the time being in force. The argument of SEBI was that the resolution plan was against the interim order of SAT. NCLAT held that such alleged violation of the interim order passed by SEBI cannot be held to be as against ‘any existing provision of law’. Accordingly, the appeal against the order of NCLT, Guwahati is not maintainable.

However, NCLAT stated that its order shall not come in the way of SEBI or any competent authority taking any steps against erstwhile promoters, directors or officers of the Corporate Debtor, if any or all of them had violated any of the provisions under the SEBI Act or rules framed thereunder or under any other law.

DECISION OF THE NCLAT

NCLAT upheld the order of NCLT, Guwahati approving the resolution plan submitted by the Successful Resolution Applicant and dismissed the appeal filed by SEBI.

Vaish Associates Advocates View

This judgement comes at a time where an IBC v. SEBI dispute is sub judice in an appeal before the Supreme Court resulting from the judgement of NCLT, Principal Bench in Bhanu Ram v. HBN Dairies and Allied Limited (decided on April 30, 2019). In the said case, the properties of the corporate debtor had been attached by SEBI. CIRP was initiated against the corporate debtor and due to the coming in force of a moratorium on the assets of the corporate debtor, after the initiation of CIRP, SEBI was directed to detach the properties of the corporate debtor. NCLT in the said case held that due to the non-obstante clause in the IBC, provisions of IBC would prevail over the provisions of SEBI and hence the properties of the corporate debtor should be detached. Aggrieved by this order, an appeal has been filed before the Supreme Court by SEBI in the case of SEBI v. Rohit Sehgal and Others.In the instant case, NCLAT has interpreted Section 61(3)(i) of the IBC which provides that if a resolution plan is in contravention of any of the provisions of any law for the time being in force, an appeal can be preferred against an order approving such a resolution plan. As per this judgement, an alleged violation of the SAT interim order does not qualify as a violation of the law in force. It is curious to note that NCLAT has not made any observations regarding the appeal filed against the order of the Single Judge Bench of the Guwahati High Court by SEBI.

The apex Court’s decision in the appeal preferred in the case of SEBI v. Rohit Sehgal and Others may ultimately resolve the conflict between the contradictory provisions of the SEBI Act and the IBC.